As leaders from around the world convene at COP28 in Dubai, there is increasing recognition and discussion around the critical role carbon removal will need to play, alongside deep emissions reductions, to reach net zero by 2050 as outlined in the Paris Agreement.

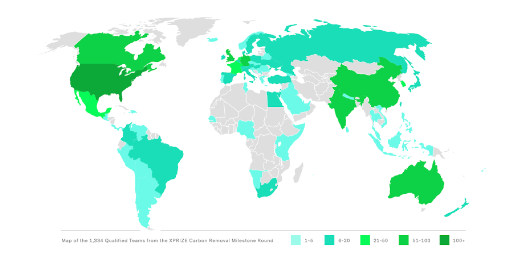

Catalyzing the growth of this new industry was the goal of the XPRIZE Carbon Removal that was launched in 2021. Since the launch of the prize, over 1,330 Teams from around the world have registered to compete, with 50% being founded since 2021. These Teams represent 88 countries and a full range of carbon removal pathways spanning the Air, Oceans, Land, and Rocks. With upwards of 8,400 individual team members, a broad range of demographics and backgrounds are represented including scientists, engineers, technologists, students, and other newcomers to the field.

As of September 2023, over 300 teams have indicated that they are ready to demonstrate a working carbon removal project in 2024. These Teams represent a significant portion of the active carbon dioxide removal industry.

The competition requires Teams to build a carbon removal demonstration that removes at least 1,000 net metric tonnes of CO2 from the air or ocean over the span of one year. To win, Teams will be evaluated on the performance of their kilotonne scale demonstration, their modeled cost at the megatonne scale, and their plan for scaling up their solution sustainably and responsibly to gigatonnes of removal annually. Promising solutions will minimize impacts and maximize benefits for both the environment and communities. Responsible deployment needs to be front and center so that this new industry can be built with equity and justice in mind from the ground up.

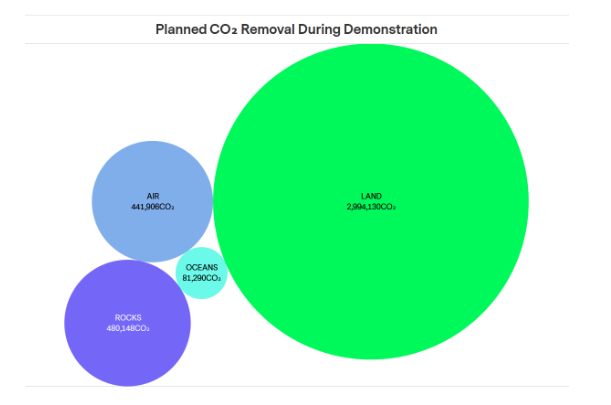

Collectively, these Teams reported they plan to remove 3,997,474 tonnes of CO2 during 2024. Broken down by track, Land Teams plan on removing the majority of this figure.

For many Teams working on first-of-a-kind technologies, the 1,000 tonne competition requirement represents a stretch goal. For more established types of removal (or more established companies), exceeding the goal will be possible. The middle 50% of Teams (representing the 2nd and 3rd quartile) reported a scale of 500-2000 tonnes, spanning the target scale for the competition. However, the vast majority of planned removal tonnage represented above (90% of the planned total) is promised by a small number of Teams (33 or 10% of the cohort).

The majority of projects represented in this cohort are based in North America (44%), but there is also significant activity in Europe (20%) and Asia (19%). There are relatively few projects at this level of maturity currently in the global south. However, there was stronger representation in the larger 1334 cohort. We hope those Teams continue to advance. The data also shows that 74 teams (22%) are developing their projects in a country other than their headquarter country, demonstrating the global nature of the CDR industry.

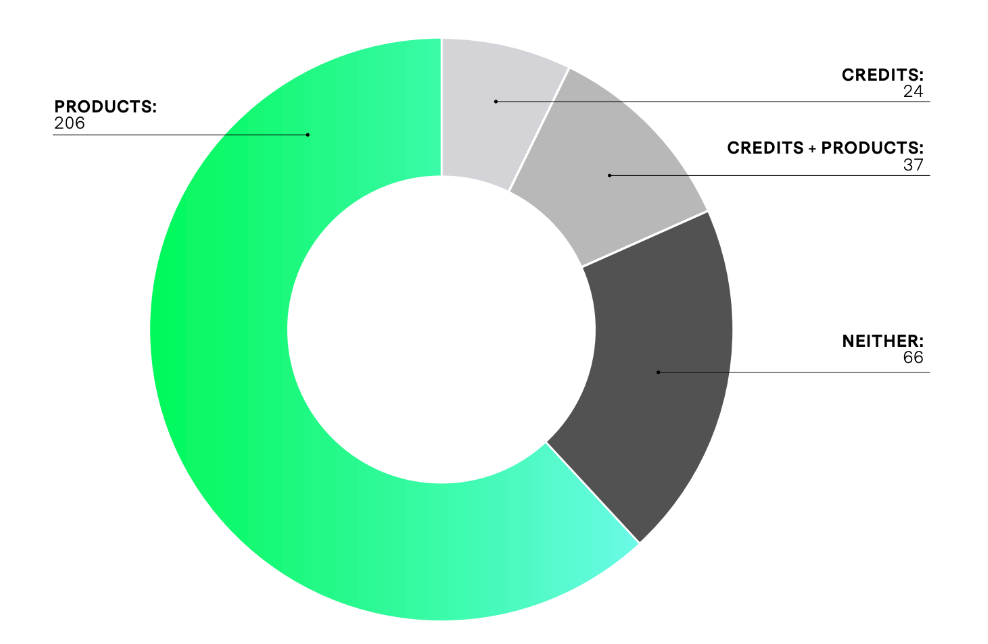

REVENUE MODELS

There are two primary revenue models to support carbon removal companies today: selling carbon removal credits and selling products. At this point in time, the majority of Teams represented in this report are pre-revenue (54%), but we expect that most will eventually sell credits. We also expect new business models to emerge moving forward, but for the time being we polled Teams on these two sources of revenue. Of the 300+ active Teams, 61 (18%) have sold credits to date and 245 (74%) are making products. The top product categories represented across all tracks are building materials, soil, energy, and biochar.

As more teams break ground on projects in 2024 and beyond, they will be dependent on new buyers coming into the market. According to the CDR.fyi Mid-Year Progress Report, 3.4 million metric tonnes of Carbon Dioxide Removal were purchased in the first half of 2023. While promising, 94% of the purchase volume can be accounted for by only 3 buyers: Microsoft, Airbus, and NextGen.

The carbon removal industry currently faces constraints on both the supply and demand side. In the immediate near term, there is a supply shortage as new companies come online and work through the challenges of deploying first of a kind of pilots: permitting, funding, supply chain delays, balance of plant designs, etc. While it is promising that over 300 companies are working towards this significant deployment milestone in 2024, ultimately, the growth of the industry will be dependent on new buyers entering the market and signaling demand for carbon removal.

Read more about the 2024 Carbon Removal Outlook by downloading the report here.